Funding Fully Automated

AI-powered platform that analyzes credit and auto-applies to 100+ lenders. All on autopilot.

Complete funding automation

Everything you need to analyze credit and secure funding

Credit Report Upload & Parsing

Upload PDFs, CSVs, or XMLs. AI extracts scores, tradelines, negatives, and inquiries instantly.

Fundability Scoring Engine

Get YES/NO fundability with approval probability, color-coded scores, and personalized recommendations.

Auto-Apply

One profile auto-fills and submits to Chase, Amex, Capital One, and more. Track all applications in real-time.

Auto-Apply: 30+ Business Loans

Submit to Bluevine, Kabbage, OnDeck automatically. Plaid-verified bank statements for instant approval.

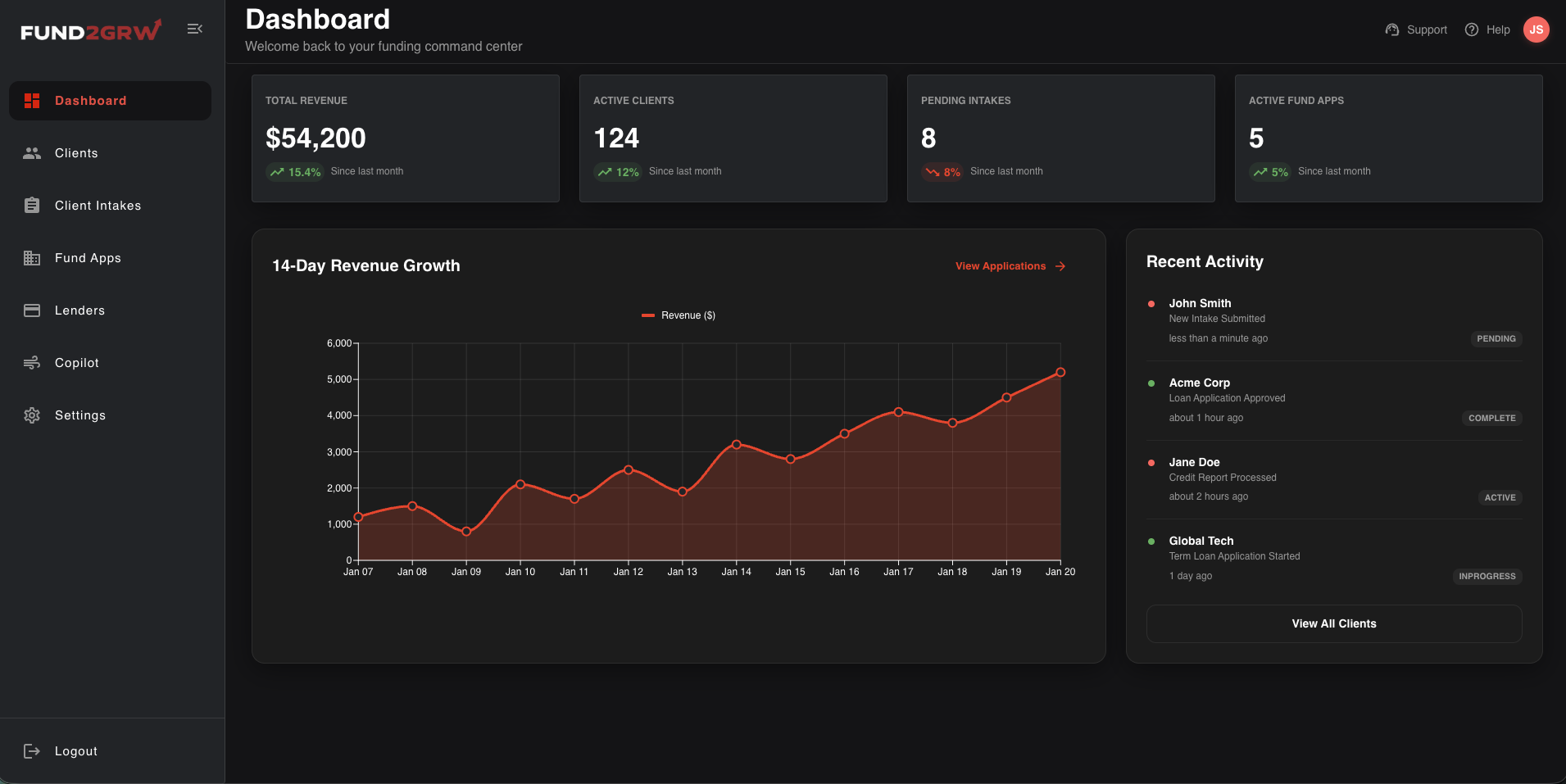

Full Analytics Dashboard

Track approvals, denials, funding totals, pipeline funnels, and export reports as CSV/PDF.

Secure Document Vault

Store and auto-attach bank statements, tax returns, and business docs with 256-bit encryption.

Platform Capabilities

Advanced tools built for your financial success

Instant Autofill

One profile auto-fills applications across all 100+ lenders instantly.

Smart Lender Matching

AI matches clients with 100+ lenders based on fundability score.

Application Tracking

Real-time pipeline tracking for all funding applications.

White Label & Affiliate System

Custom branding, domains, and commission tracking for funding professionals.

How we automate your funding

No complexity. Just clean, effective funding in three simple steps.

Get StartedAnalyze setup. Surface fundability instantly.

The system scans your credit profile the moment you upload, uncovering approval odds and matching lenders — before you apply.

Smart Match. Target the right lenders.

Our AI cross-references your profile against 100+ lender underwriting models to find your highest probability matches.

Auto-Execute. Funding on autopilot.

One click to submit applications. We handle the forms, documents, and follow-ups automatically.

Why Fund2Grow?

50+ credit cards and 30+ business lenders in one platform

From credit parsing to application submission—zero manual work

Fundability analysis and smart lender matching

Custom logos, domains, and branding for your funding business

Serious Funding Power.

Simple Pricing.

Built for funders at every stage — from first client to full-scale operation.

Simple pricing. No contracts. Just leverage.

Starter

Ideal for new or solo funders managing their first clients and getting deal flow organized

- Client CRM Dashboard Up To 6 Clients

- Up To 15 Auto Applies

- Funding Readiness Score

-

Document Vault -

Support -

Branded Client Portal -

Team Access

Scale

Built for active funding businesses managing multiple clients and automating approvals at scale

- Client CRM Dashboard Up To 10+ Clients

- Up To 30+ Auto Applies

- Funding Readiness Score

- Document Vault

- Support

- Branded Client Portal

- Team Access

Why choose Fund2Grow?

See how we compare to traditional funding methods

| Features | Fund2Grow | Traditional Brokers | DIY Process |

|---|---|---|---|

| Number of lenders | 100+ | 10-20 | Manual research |

| Application process | ✓ Fully automated | ✕ Manual | ✕ Manual |

| AI fundability scoring | ✓ | ✕ Manual review | ✕ Guesswork |

| Application tracking | ✓ Real-time dashboard | ✕ Email/phone | ✕ Spreadsheets |

| White label branding | ✓ | ✕ | ✕ |

| Time to apply to all lenders | Minutes | Days to weeks | Weeks to months |

| Document management | ✓ Secure vault | ✕ Paper-based | ✕ Manual storage |

| Multi-lender auto-apply | ✓ | ✕ One at a time | ✕ |

Frequently asked questions

What is Fund2Grow and how does it work?

Fund2Grow is an AI-powered funding platform that automates the entire lending process. It parses credit reports, analyzes fundability, and auto-applies to 100+ lenders including major banks and fintechs. It's designed to help funding professionals and business owners secure capital faster and with higher approval rates.

How do I get started on Fund2Grow?

Simply sign up and get started today. Once logged in, you can upload a credit report (PDF, CSV, or XML) to instantly generate a fundability score. From there, our system will recommend the best lenders and you can start submitting applications with a single click.

Is client data secure?

Yes, security is our top priority. We use bank-level 256-bit encryption for all data transmission and storage. Your client's sensitive information, including SSNs and financial documents, is stored in a secure vault that complies with SOC 2 standards.

What lenders can I apply to?

Our network includes over 80 lenders, ranging from Tier 1 banks like Chase, Amex, and Bank of America, to fintech lenders like Bluevine and OnDeck, as well as SBA lenders. The platform automatically matches you with lenders based on your specific credit profile and business data.

How can I contact customer support?

You can reach our support team 24/7 via the in-app chat or by emailing support@fund2grow.ai. Enterprise plans also include a dedicated account manager for priority assistance.

Still have questions?

Contact our support team →Ready to Automate Your Funding Business?

Join funding professionals using Fund2Grow to close more deals, faster.

Join Now →